At what age does a credit report begin? This indicates an excellent experian credit score and is well above the average.

What Is A Good Credit Score In Australia - Credit Simple

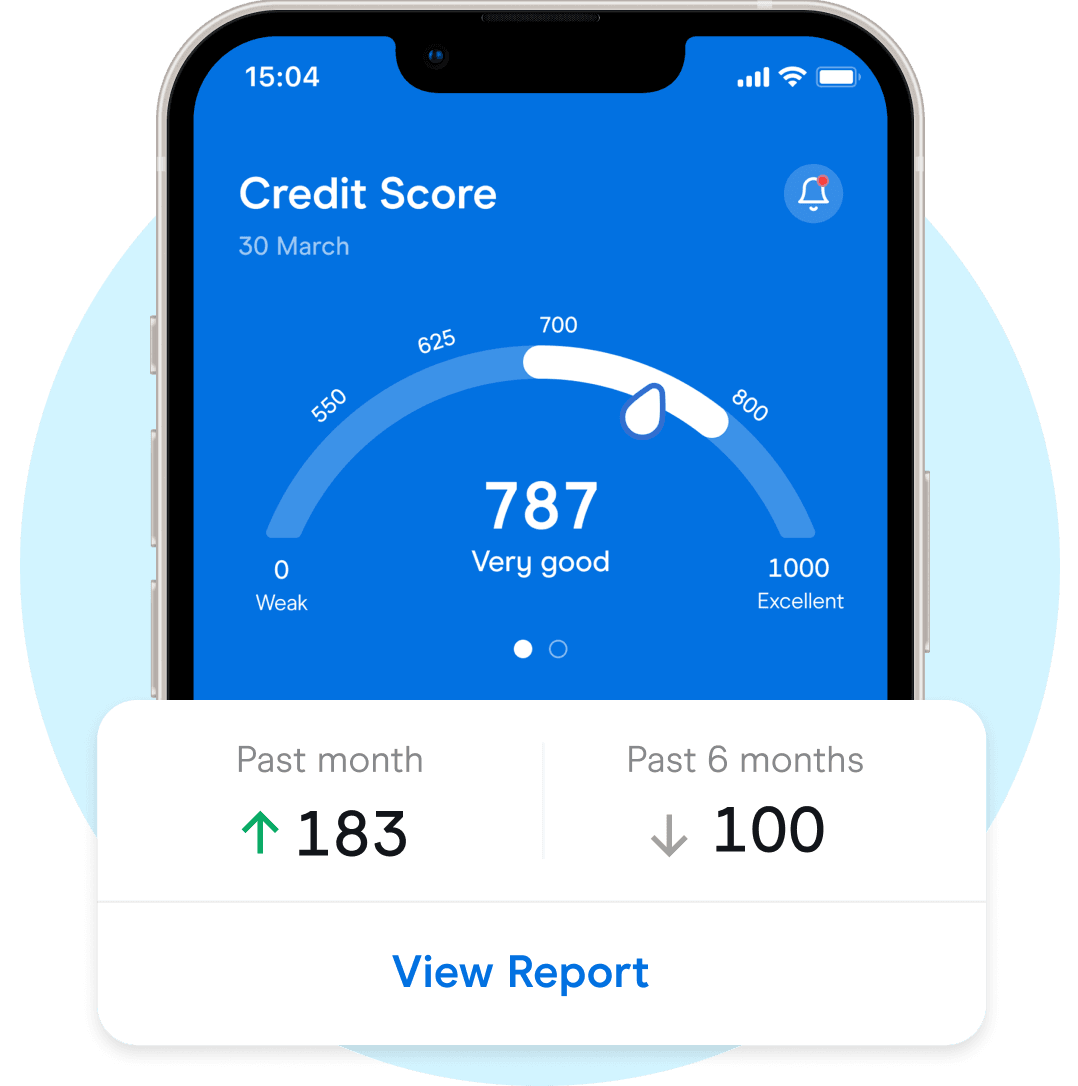

Credit scores, which are determined independently by australia's three credit reporting agencies, range between 0 and 1000 or 1200 (depending on the credit bureau), and most people will start out their history somewhere in the middle, ranging from 300 to 600 depending on the types of credit they have and how they use it.

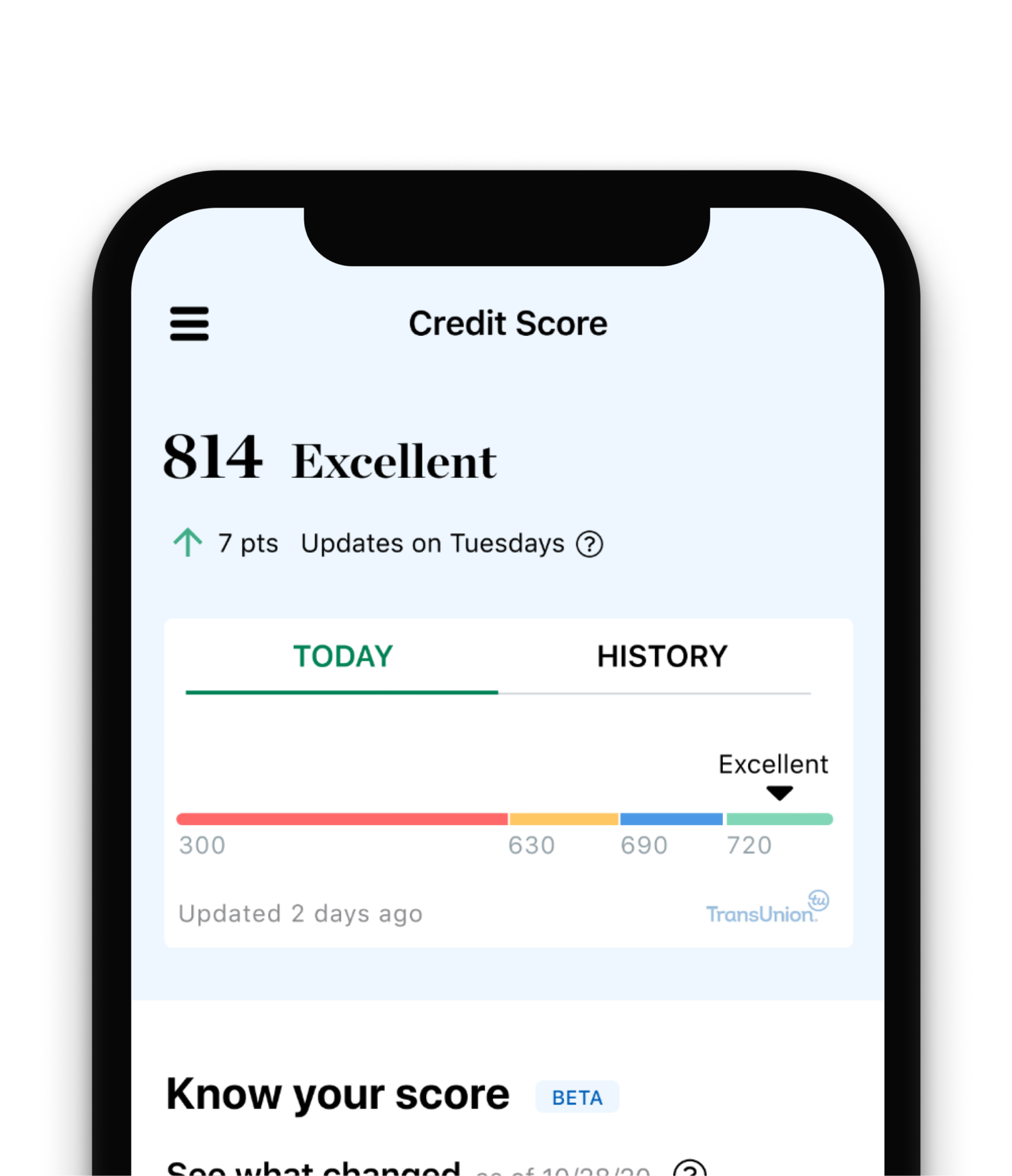

Starting credit score australia. This indicates a fair experian credit score. If your credit report shows scores out of 1,000, above 690 is excellent and above 540 is good. If your credit report shows scores out of 1,200 then as a rule of thumb a score above 853 is excellent while above 661 is good.

In short, an australian credit report may begin at 18 years old. Generally, a higher credit score is considered better as it indicates lower risk. A good credit score is between 622 and 725, a very good score is between 726 and 832 and an excellent score falls between 833 & 1200.

Your credit score from getcreditscore is generated by australia’s leading. Here’s how equifax (formerly known as veda) determines which categories different scores fall within: Contact australia's leading credit repair, debt negotiation & advocacy services.

But it's highly unlikely your first credit score will be that low, unless you start off with very poor credit habits. But there are a couple things to keep in mind. Ad we help find & compare loans for any purpose without accessing your credit file.

Your score is usually on a scale between 0 and 1,200 or between 0 and 1,000 depending on the reporting agency you use to check your score. Your equifax credit score takes into consideration personal circumstances, such as age, as well as ‘stability factors’, such as how long you’ve been employed in your current position and how long you’ve resided at your current residential address, to help assess credit risk default information. Default information on your personal or business credit report, such as overdue debts, serious credit.

Contact australia's leading credit repair, debt negotiation & advocacy services. This could mean getting a. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45% of your number.

What credit score do you start with australia you are able to test your credit history to get free of credit score sesame to assess whether you collapse inside the nice' credit range. In australia, if you want to apply for any financial products, such as a credit card, car loan or a home loan, you’ll need to meet certain eligibility criteria around age. Credit scores are just one indicator of your credit risk and may be used by credit providers like banks and credit card companies to help understand how responsible you are to lend to.

This indicates a very good experian credit score and is above the average. Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200. You now know a lot more about your starting credit score, and the good news is that whatever your initial score is, there are several ways to build a positive credit history — and keep a good credit history and credit score.

Ad we fix credit offers a complete service for those who want credit repair in australia. Ad we fix credit offers a complete service for those who want credit repair in australia. Ad we help find & compare loans for any purpose without accessing your credit file.

Once you begin to establish a credit history, you might assume that your credit score will start at 300 (the lowest possible fico ® score ☉). This is usually only 2% or 3% of the amount owing, which leaves the rest to attract interest. Nor will your first credit score be the highest level (under the two most commonly used credit scoring models, fico ® and vantagescore ®, that's 850).

This indicated a good experian credit score and is in the average. Different credit scoring agencies calculate your credit score slightly differently. If this grows into unmanageable debt, this could hurt your credit score.

A higher score means the lender will consider you less risky. Your credit score rating might be negatively impacted, which makes it more complicated to. Banks and creditors use your credit score when deciding whether to lend you money or approve your loan application.

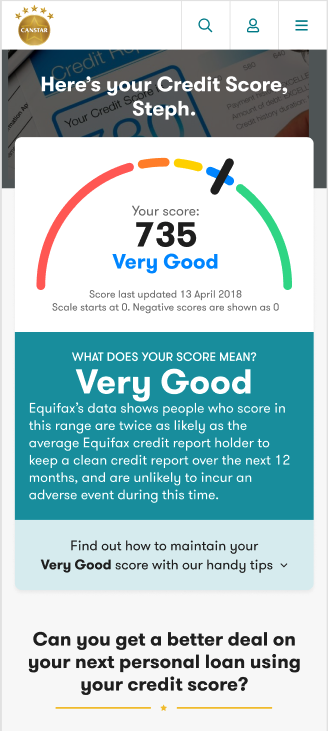

What is a good credit score in australia? Locally in australia, clearscore relies on the experian system for working out credit scores, applying a score between 0 and 1000 to work out how your credit is rated. For experian credit scores, a score between 625 to 699 is considered ‘good’, 700 to 799 is ‘very good’, while scores of 800 and up are deemed ‘excellent’.

Credit Repair Dictionary Credit Repair Reviews Australia The Easy Section 609 Credit Repair Experian Credit Report Credit Repair Credit Card Infographic

How Do You Check Your Credit Score Canstar

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2021 Badcreditorg

2

What Is A Good Credit Score In Australia Canstar

How Credit Scores Work In New Zealand - Moneyhub Nz

Changes To Credit Reporting - Commbank

How Do You Check Your Credit Score Canstar

2

How To Understand Check Your Credit Score

What Is A Good Credit Score In Australia - Credit Simple

2

Finder Credit Score Get Your Free Report In Just Minutes

What Is A Good Credit Score In Australia - Credit Simple

How Do You Check Your Credit Score Canstar

Finder Credit Score Get Your Free Report In Just Minutes

How To Apply For A Credit Card Without A Social Security Number - Nerdwallet

Experian Order Credit Score Improve Your Credit Score Fico Score

Corporate Lending Httpwwweternalkeyinvestmentsllccomcredit Credit Repair What Is Credit Score Small Business Loans

Comments

Post a Comment